All Resources

Are You Wealthy?

Wealth of Wisdom Podcast, Episode 21, 2018 In the first chapter of the book, Wealth of Wisdom (McCullough & Whitaler), Patricia Angus tells a fascinating story about a conversation she had with a cab driver about wealth and life and…

Six Ways To Improve Family Business Governance

All business-owning families already have governance in place on multiple levels, but it’s often overlooked.

By Patricia M. Angus – Originally published in Trusts & Estates, March 15, 2017 Families who own businesses often overlook the challenge that is “governing” all that they do together inside, and outside, of the business. To some, governance itself is…

Successfully Climbing the Growth Ladder in Family Enterprises: Highlights from Columbia Business School’s annual conference.

By Patricia Riberas – Originally published in Trusts & Estates, March 10, 2017 On Feb. 17, 2017, family business owners, advisors and managers gathered at Columbia Business School’s Fourth Annual Family Business Conference to discuss “From Family Business to Family Enterprise:…

A Bridge Too Far?

By Patricia M. Angus – Originally published on Wealth Management.com on March 7, 2017. How academia is essential to the future of family, business and society For too long, family business was not only off the radar of graduate schools…

Governance for Business-Owning Families (Part I): An often overlooked challenge

By Patricia M. Angus – Originally published in WealthManagement.com March 2017 Families who own businesses face a challenge they often overlook, that is, “governing” all that they do together inside, and outside, of the business. Admittedly, governance itself is fraught…

The Year of Governance: A dominating theme on the global, national and family levels

By Patricia M. Angus – Originally published in Trusts & Estates, January 2017 Some years, it’s difficult to look back across 12 months and find a common theme. The year 2016 wasn’t one of those years. Instead, there’s one word that…

21st Century Trustees

By Patricia M. Angus – Originally published on FFI Practitioner on November 16, 2016. Business is all about the future. An entrepreneur takes an idea and makes it into a service or product that people will want even need, for…

Are You “Wealthy”?

Questions for the Industry and Our Clients

By Patricia M. Angus – Originally published on WealthManagement.com June 2016 Recently, I took a taxi to the airport after leaving a conference focused on the challenges and opportunities of families with “great wealth” — that is, families with extraordinary…

After the Plan: Guiding Personal Trustees

By Patricia M. Angus – Originally published on Wealth Management.com in May 2016. Many years ago, when I was a young lawyer, a new client, “Tom,” entered our offices. He was quite concerned—his friend, “Sam,” had appointed him as trustee…

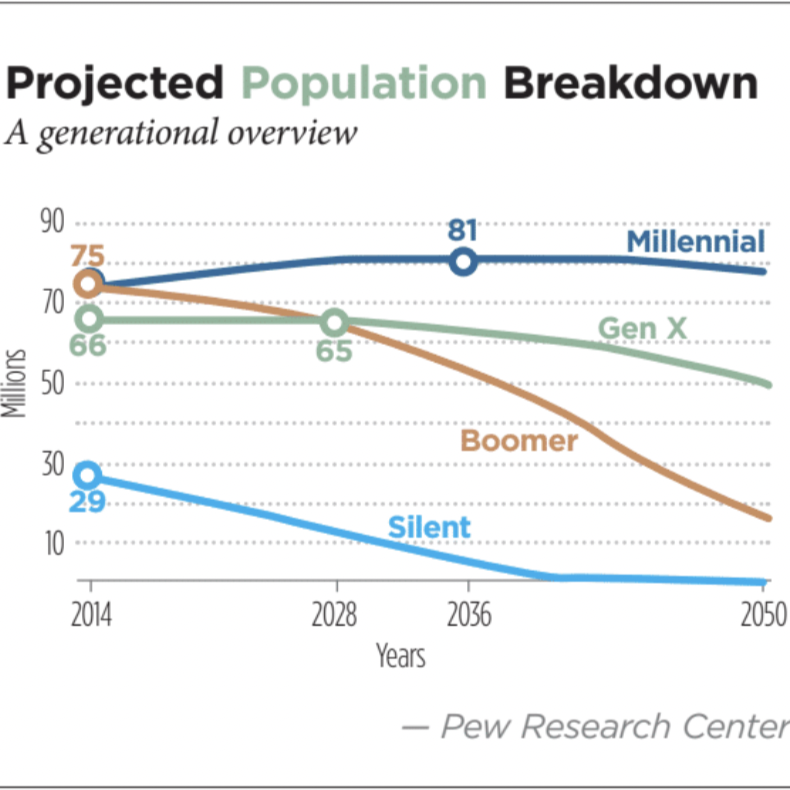

Next Gen 2.0: Taking things to a higher level

By Patricia M. Angus – Originally published in Trusts & Estates in March 2016. You can’t miss it (or them). “Next Gen” is everywhere. The private wealth management industry is awash in Next Gen summits, educational programs, research studies and…

Eureka! Was 2015 the year family business was “discovered?”

By Patricia M. Angus – Originally published in Trusts & Estates, January 25 2016 Looking back some day, 2015 might be known as the year that family business was “discovered,” at least by a group far larger than those specializing in…

Hearing Women’s Voices in Wealth Planning: Bringing Everyone to the Table

By Patricia M. Angus – Originally published on Wealth Management.com in October 2015. Earlier this week, I spoke at a conference on Private Wealth Management in Latin America. While that region may not be known for its cutting edge approach…

What Do Women Really Want? Estate Planning Tailored to Women’s Needs

By Patricia M. Angus – Originally published in Private Wealth Management in 2004 Sigmund Freud, who figured out a great deal about the human psyche, was unable to answer one key question: “What do women really want?” A century later,…

Mindfulness in Advisor-Client Relationships

By Patricia M. Angus – Originally published on WealthManagement.com on May 27, 2015 By slowing down and looking inward, a financial advisor who’s having difficulty with a client might better understand what’s really happening. “Mindfulness” is a movement on the…

Estate and Wealth Planning for Family Enterprises: Reality – Not Myth – as the Proper Starting Point

By Patricia M. Angus – Originally published on FFI on April 15, 2015. The 2015 FFI Global Conference theme of “myths and realities” provides an excellent opportunity to focus attention on how best to advise family enterprises for the long-term…

Beyond the Traditional Estate Planning ‘Choices’: Expanding the Options

By Patricia M. Angus – Originally published on Wealth Management.com in March 2015. Estate planners often advise clients that there are only three places where you can leave your assets at death: family, taxes and charity. It became popular to…

Should Parents Tell Their Adult Children What’s in Their Estate Planning Documents? Yes.

By Patricia M. Angus – Originally published on Wealth Management.com in February 2015. In general, transparency is the best approach. In general, I believe transparency is the best approach to estate planning when a client has adult children. Of course,…

Changing Lenses: How perspective affects family wealth advising

By Patricia M. Angus – Originally published in Trusts & Estates, January 29, 2015 As an amateur photography student, I’ve spent many hours learning about techniques and tools to improve my skills in taking, making and presenting photographs. As I’ve been…

Donor Networking

By Patricia M. Angus – Originally published in Trusts & Estates, 2015 New philanthropists often are baffled by challenges after their foundation is established or donations are made. Here’s how to help them help themselves. Charitable giving through private foundations, trusts…

Planning Trust Administration to Avoid Conflict

By Patricia M. Angus – Originally published in WealthManagement.com in December 2014 In wealth management, the trust is the most common structure used to realize our widely recognized and accepted freedom of disposition. Within broad parameters, the law of trusts…

Who We Remember: Every Life Has a Story

“Whose life story from your own family would you most want to have documented on film?” In this moving episode of Who We Remember, host Jamie…

Themes for Family Businesses in 2023:

Uncertainty and digitalization are among the challenges.

By Patricia M. Angus – Originally published in Trusts & Estates, December 2022 Will 2023 be the year that the pandemic is put behind us? Will…

From Textiles to Multi-generational Wealth: The Shah Family Enterprise

By Patricia M. Angus – Originally published on Columbia CaseWorks, Spring 2024 What are the factors that drove a family-owned chemical company’s success, and how…

Trust Ownership of Family Businesses:

Planning for the Future

By Patricia M. Angus – Originally published in Trusts & Estates, February 2024 The scenario is all too common. The founders (or non-founding owners) of a…

Everything Everywhere All at Once?

Family Enterprises in 2024

By Patricia M. Angus – Originally published in Trusts & Estates, January 2024 The 2023 Academy Awards ceremony was quite a sweep for the film Everything…

Audiobook – The Beneficiary Primer: A Guide for Beneficiaries of Family Trusts

Have you been named as beneficiary of a family trust? Does it feel overwhelming? Are you looking for some practical information to get up to…

Wealth Transfer Between Generations, Primer for Trustees and Beneficiaries

In this episode of the podcast Talking Billions, Patricia talks with Bogumil Baranowski of Sicart Associates, LLC. Together they explore:Trusts: what they are, where they…

Complex Family Enterprise: A new way to describe a growing phenomenon

By Patricia M. Angus – Originally published in Trusts & Estates, March 2023 Trusts and estates practitioners (for example, lawyers, accountants and investment advisors) take their…

Your Family Business Needs a Board

By Patricia M. Angus, published in Harvard Business Review, September 08, 2022 A board should be at the helm of any family business, steering the business…

Mental Health and Estate Planning

Patricia joins Arden O’Connor of the Beyond the Balance Sheet podcast in a discussion about estate planning with mental health and addiction issues in mind….

In Tax We Trust: Implications of growing societal and client trends

By Patricia M. Angus – Originally published on WealthManagement.com on February 13, 2022 Most private wealth advisors (including trusts and estates lawyers, accountants and investment…

Virtual Fireside Chat with Leading Family Enterprise and Family Office Experts

The role of family offices in structuring and advising families with regards to liquidity events and family dynamics. Strategies for families to intelligently run and manage the risks associated with private wealth and operating businesses concurrently…

Sustainable Growth Drivers for Family Enterprises

This webinar draws from the experiences of different stakeholders, explores how family businesses in Africa have evolved, the challenges faced, and the main drivers behind…

The Purpose and Power of Family Governance

By Patricia M. Angus – Originally published as a blogpost for NCFP, June, 2021Excerpt from “Passages Issue Brief: Enhancing Your Family Philanthropy with The Family Governance…

How Should Wealthy Parents Treat Wayward Offspring?

By Emma Jacobs – Originally published in Financial Times on May 26, 2021Giving children too much money, too early, risks indulging them and making them…

Tamarind Learning Podcast: The Beneficiary Primer

In this podcast, Patricia Angus, Managing Director of the Global Family Enterprising Program and Faculty Director of the Enterprising Family Executive Program at Columbia University…

Primer on Family Trust Beneficiaries:

Things to Consider

In this episode of FFI Practitioner‘s weekly podcast, FFI Fellow Patricia Angus discusses her most recent book, The Beneficiary Primer: A Guide for Beneficiaries of Family…

Tamarind Learning Podcast: The Trustee Primer

In this podcast, Patricia Angus, Managing Director of the Global Family Enterprising Program and Faculty Director of the Enterprising Family Executive Program at Columbia University discusses her book, The Trustee Primer, with Kirby Rosplock, PhD, Founder and CEO of Tamarind Partners.