How to Start on the Path to Long-term Wealth Preservation and Growth

By Patricia M. Angus – Originally published in Private Wealth Management, 2005

Although each family is unique, all wealthy families face the challenges of how to preserve and build wealth over the long-term. Families struggle with managing property that is jointly owned (e.g. family business or co- investments) and/or in which family members have joint interests (e.g. trusts or real estate). Assets are frequently tied together, for tax and other reasons, with- out consideration of how the family will administer them. Many families also fear that wealth will reduce motivation and be used unproductively by heirs. Although family governance has been adopted by a growing number of families as a way of addressing these concerns, more could benefit but are not familiar with what it is, and how it works.

What is family governance?

Governance is “the act, process or power of governing; the state of being governed”. To govern means “to control the actions or behaviour of; guide; direct… exercise sovereign authority”.

Most wealthy families establish structures to minimize taxes and order their affairs (e.g. wills, trusts, companies, other vehicles), which essentially create a form of governance. That is, legal authority is given to certain family members or advisors to guide, direct and, occasionally, control the behavior of others in the family. For example, a trustee can guide the behavior of a beneficiary based on whether, and how, the trustee exercises discretion over trust distributions.

The ways in which governance is understood and carried out profoundly impact relationships between family members. It is one thing for a parent to make a recommendation to an adult child about how the child lives his or her life. It is quite another, as trustee, to have the legal power to make distributions of funds from a trust. Family governance is the process of making and administering principles, policies and practices established by family members to manage these complexities.

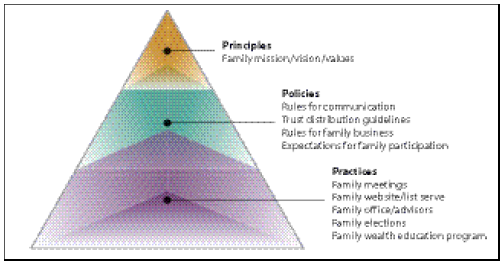

Family governance derives from an overriding set of principles based on the family’s values and long-term sense of purpose for the family itself. These principles may be articulated through a mission/vision statement or a list of agreed-upon values. These principles are effectuated through a series of policies on how family members will interact with each other with respect to their common issues. Day-to-day practices implement the governance system (Figure 1). The family may appoint family members to be responsible for various aspects of these affairs. For example, one family member oversees investments, while another guides the family’s philanthropy. The family may manage these affairs themselves informally, or formally through a family office or outside service provider.

What are the stages of development of family governance?

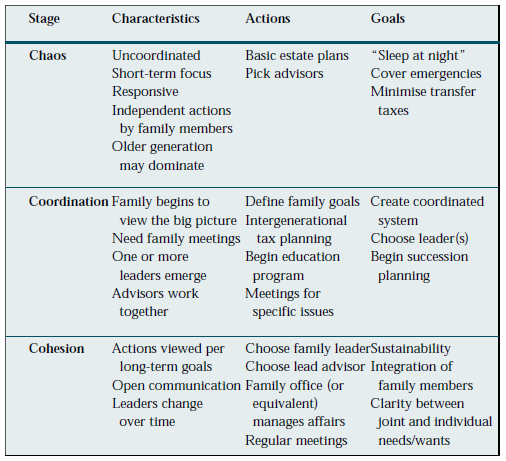

There are three basic stages in the development of a family governance system (Table 1). Most families – whether they know it or not – are in the first stage – chaos. This does not mean that the lives of family members are chaotic. Rather, most family members remain focused on their day-to-day lives while making investments and creating legal structures that respond to specific needs. These structures are generally uncoordinated with each other. This proceeds well until a major event requires the family to move to the next stage: coordination.

During the coordination stage, one or more members of the family takes steps to find a way to manage the family’s affairs more efficiently. Often, the initial emphasis is on crisis management, for example administering an estate or selling a family business. Later, the family moves into long-term issues of succession and wealth transfer. Family meetings are needed, generally for specific issues, such as a reading of a will.

The family should use this stage as an opportunity to focus on some principles and policies. It is also useful to take an inventory and determine which areas must be handled jointly, and which can be done separately. For example, personal estate planning is an individual endeavor; jointly owned real estate requires governance.

During the third stage, the family reaches a level of cohesion in its affairs. It has an understanding of its guiding principles and policies, and follows a schedule of formal family meetings. The family may create a Family Council, with representatives from the family and its advisors. The family decides whether to establish a family office.

How can a family begin to create a governance system?

All wealthy families must come to the realization that they have already begun to create a governance system, whether intended or not. Some thoughts on how to move the process along follow below.

1. Take inventory:

The family must take an inventory and determine the status of their governance system. For example, has the oldest generation created legal structures that will determine the way in which the next generation inherits its wealth? What are the terms of these structures? Who will manage them? Is the next generation educated sufficiently to take on their roles (e.g. as trustee or executor)? If legal structures have not been created, how will property pass under applicable law? In addition, the family should review the intellectual and emotional health of its members. Are family members living up to their personal capabilities? Are there conflicts within the family that are likely to arise in the future? Do current legal documents take these into account?

2. Ascertain family principles:

As no governance system will be sustainable without an overriding set of guiding principles, the family must learn which values they hold in common with each other. This should derive from family history and the individuality of its members, and focus on the areas of overlap. If the family is open to the process, they may learn that they hold more in common than they expect. The family may develop a mission/vision statement. If family wealth is primarily consolidated in one generation or one individual it is essential that other members (future inheritors) are included in the process for healthy wealth transfer and growth to succeed.

3. Establish policies:

The family needs to agree on how deci- sions will be made and how issues of common concern will be handled. How often will family meetings be held? Who can attend? Who can vote? How will decisions be made? What are the require- ments for access to a family office? The family should remain aware of legal requirements of their wealth structures (e.g. voting rights in a family limited partnership) and see whether they can be changed if necessary to adapt to family wishes.

A family may develop a Constitution to articulate its principles and policies. It might also decide to establish a Family Council, or a series of meeting groups, as a means of developing and deciding policies for the family. For example, the Family Council might have a representative of each branch of the family. Younger members might be able to attend, but not vote.

4. Define and refine family practices:

Day to day practices will, ideally, hold the family governance system together. Once the family has decided on the issues of common concern, they must establish a regular practice to address them as a family. If the family creates a family office, documentation and authority must be transferred over to it to handle these issues. Before and just after a transition event, communication through meetings or otherwise will be essential.

5. Foster the right environment:

Family governance experts agree that a family governance system cannot work – and the family cannot succeed – with- out the following:

- respect for each individual’s uniqueness;

- open communication;

- sense of community;

- distinction between group and individual needs and wants;

- respect for rules.

A family does not need to immediately become expert in family governance to start obtaining its benefits. Rather, through principles, policies and practices it will work toward governing itself for the purpose of successfully preserving and growing wealth over the long term.